Kiwi Credit Card Referral Code FPXSNT

Kiwi is a credit card app powered by Axis Bank that allows you to earn cashback on your spending. You can also refer your friends to Kiwi and earn cashback when they sign up using a referral code and start using the app. It’s Rupay Credit Card UPI Enabled so you can directly make payments using any UPI app like Phonepe etc. If you want to get HDFC Ruapy Credit Card or ICICI Rupay credit card without waiting, check our latest posts

Kiwi provides a Rupay Axis Bank credit card, which means you can link your card with Phonepe or any other UPI apps and pay merchants directly from your credit card not only this. This will be an Axis Bank credit card so You will also get discount offers on Flipkart/ Amazon and 1% cashback on all the transactions you made using this card.

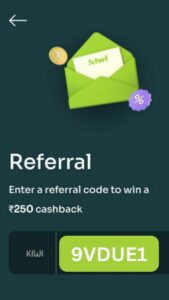

Kiwi App Referral Code

| Kiwi Referral Code | FPXSNT |

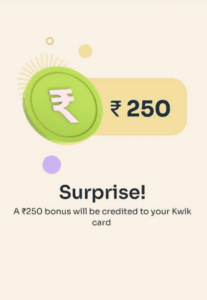

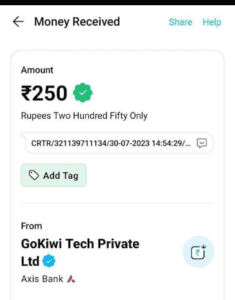

| Signup Bonus | ₹250 Cashback |

| Referral Bonus | ₹1000 Cashback |

| Download Link | Download |

| Fee & Charges | Lifetime Free Credit Card |

| Card Type | Rupay Credit Card |

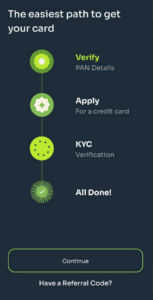

How To Get Rupay Credit Card From the Kiwi app & Rs.250 Cashback with Referral Code

1. First of all click on the below link to download the Kiwi app from Play Store

2. now open and enter your mobile number, verify it using OTP.

3. Now click on enter referral code option from this screen

4. Now enter Kiwi referral code: FPXSNT

Kiwi Referral Code is FPXSNT

5. Enter your name and referral code to get free ₹250 cashback after approval

4. Now Enter some of your basic details like name, email address, father’s name, occupation, education, etc.

5. Now you can wait for 5-10 minutes until the application is in progress.

6. Once the application is verified, You can now see an option for video call KYC.

7. Start video call KYC to get approval from Axis Bank

8. once done, You will get an instant virtual credit card that you can use anywhere, there will be a limit for the first 24 hours.

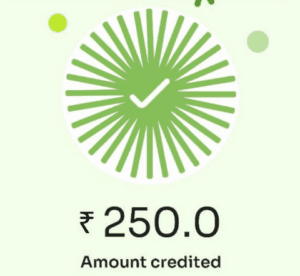

9. Now complete your first transaction with the card & get Rs.250 cashback in the form of Kiwi points

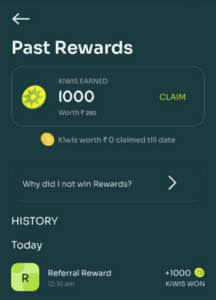

10. You will have 1000 Kiwi Points that you can redeem for Rs.250 cashback directly in your bank account

10. You can earn 1% cashback on other transactions.

Kiwi Credit Card Refer & Earn

Not only does the Kiwi Credit Card offer convenience and rewards, but it also allows you to gain even more with its “Refer & Earn” program. By referring friends and family to Kiwi, you can earn a bonus reward for each successful referral. This simple yet rewarding program allows you to share the benefits of Kiwi and earn extra rewards along the way. So, spread the word and watch your rewards grow with Kiwi Refer & Earn!

FOr Each referral, Kiwi is offering Rs.250 Per referral in your bank account directly.

How To Redeem Kiwi Rewards

1. Click on the rewards section from the home screen.

2. Now You will see 1000 Kiwi rewards.

3. Click on the Redeem button to withdraw it to your bank account.

4. Instantly you will get credit to your UPI linked account.

Features of Kiwi Credit Card

- Lifetime free card: There are no annual or joining fees for the Axis Bank Kwik Credit Card.

- Instant virtual card: You will receive an instant virtual card on approval, which you can use to start making payments right away.

- Earn EDGE reward points: You will earn 2 EDGE reward points for every Rs.200 spent on the card. These points can be redeemed for gift cards, travel, or other merchandise.

- Fuel surcharge waiver: You will get a 1% fuel surcharge waiver on fuel spends between Rs.400 and Rs.4000.

- Zero liability protection: You are not liable for any fraudulent spends made with the card in case of timely reporting of theft or loss of the card.

- UPI payments: You can link your Axis Bank Kwik Credit Card to UPI and use it to make payments through Google Pay, Paytm, and other UPI apps.

Does Kiwi Credit Card have a Launge Access Program?

No Kiwi Card does not come with Lounge Access

Requirements

- Age: You must be at least 18 years old and a resident of India.

- Income: You must have a minimum monthly income of Rs.25,000.

- Credit score: You must have a good credit score.

- Documents: You will need to provide your PAN card, Aadhaar card, and recent salary slips.

- You must have a valid mobile number and email address.

- You must be able to provide proof of residence.

- You must be able to provide proof of employment.

Apply Process for Kiwi Credit Card

Kiwi Refer & Earn Terms and Conditions

The Kiwi referral code offer is subject to the following terms and conditions:

- The offer is only available to new users who sign up for Kiwi using a referral code.

- The offer is only valid for the first purchase made by the new user.

- The cashback will be credited to the new user’s account within 30 days of the purchase.

- The offer is not valid for purchases made on gift cards or travel insurance.

Top 10 Questions & Answers Related to KIWI Credit Card

1. What documents are required to apply for the Kiwi Credit Card?

To apply for the Kiwi Credit Card, you will need:

- A valid PAN card

- A valid Aadhaar card

- Proof of income (salary slip, bank statement, etc.)

2. What is the minimum income requirement to apply for the Kiwi Credit Card?

The minimum income requirement to apply for the Kiwi Credit Card is currently Rs. 25,000 per month.

3. How long does it take to get approved for the Kiwi Credit Card?

The approval process for the Kiwi Credit Card is typically quick and takes around 24-48 hours.

4. What is the credit limit for the Kiwi Credit Card?

The credit limit for the Kiwi Credit Card varies depending on your creditworthiness and income. It can range from Rs. 10,000 to Rs. 5 lakhs.

5. How do I earn rewards with the Kiwi Credit Card?

You can earn 2x reward points on all your spends with the Kiwi Credit Card. These points can be redeemed for exciting rewards like gift cards, travel vouchers, cashback, electronic items, and more.

6. How do I redeem my reward points?

You can redeem your reward points through the Kiwi app. Simply log in to your account and navigate to the rewards section. You can then browse the available rewards and choose the one you want to redeem your points for.

7. What are the charges associated with the Kiwi Credit Card?

The Kiwi Credit Card has a competitive interest rate and transparent charges. The Annual Percentage Rate (APR) is 24%-36%. Late payment charges can be up to Rs. 500, and over-limit charges can be up to Rs. 500.

8. Is the Kiwi Credit Card safe to use?

Yes, the Kiwi Credit Card is safe to use. Kiwi employs various security measures to protect your information, such as multi-factor authentication, secure data encryption, and regular security audits.

9. What happens if I lose my phone?

If you lose your phone, you can immediately block your virtual card through the Kiwi app. This will prevent any unauthorized transactions. You can then contact Kiwi customer support to report the lost phone and get assistance with replacing your virtual card.

10. Can I use the Kiwi Credit Card outside of India?

Currently, the Kiwi Credit Card can only be used within India. However, Kiwi is working on expanding its services to other countries in the future.

Conclusion

The Kiwi referral code offer is a great way to get started with Kiwi and earn some cashback. By referring your friends to Kiwi, you can also earn cashback when they make their first purchase. So what are you waiting for? Start referring your friends today!

Not only this Kiwi Credit card is an instant Credit card application where you can get a lifetime free Rupay Credit card powered by Axis Bank. You can use it with UPI and what not. You can keep earning 1% cashback on all the transactions.

Here are some additional tips for using Kiwi referral codes:

- Share your referral code on social media and with your friends and family.

- Use your referral code when you make your own purchases.

- Check the Kiwi website and app for special referral code offers.

![[jUXSAl0ENwO] SBI Card Referral Code : Get ₹500 Amazon Voucher on Card Approval 12 Kiwi App Referral Code](https://www.bigtricks.in/wp-content/uploads/2023/12/image-370x250.png)

![[CPFE2627] Magicpin Referral Code - Signup & Get Rs.250 Off| Rs.125 Per Referral 15 Kiwi App Referral Code](https://www.bigtricks.in/wp-content/uploads/2020/03/photo_2020-03-03_10-41-53.jpg)

![[SONU1612] Tata Neu Referral Code : Lifetime Free Credit Card With Upto 7% Cashback on Shopping 22 Kiwi App Referral Code](https://www.bigtricks.in/wp-content/uploads/2023/12/Tata-Neu-Referral-Code-370x250.jpg)

Leave a Comment